DAVE RAMSEY’S TIPS FOR SAVING MONEY ON TRAVEL

For those with money to spend and the time to spend it, the sky’s the limit. However, for most Americans, money is tight and time is valuable. Vacationing is a luxury — if you can afford it, you can’t afford to overspend on it.

Find: 6 Vacation Splurges You’ll Almost Always Regret See Our List: 100 Most Influential Money Experts

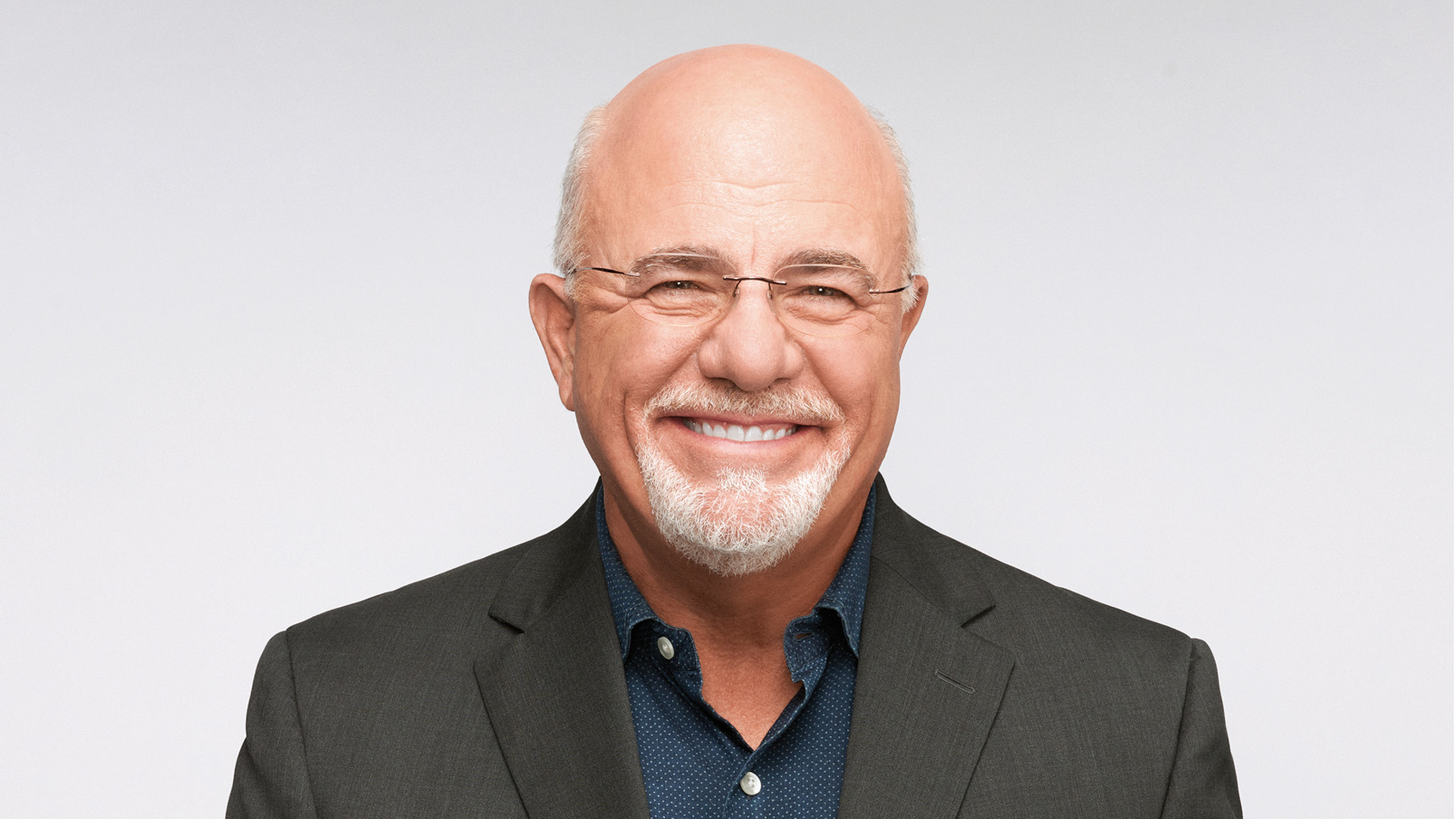

According to a recent Forbes consumer survey, an overwhelming 87% of respondents plan on travelling as much in 2023 as they did in 2022, and 49% expect to travel more. But as financial expert Dave Ramsey stated, you can’t let a vacation mindset derail your money goals.

Of course, Ramsey would prefer you to skip the vacation altogether if you are honestly trying to save money. “When your goal is to save money now, a vacation is the worst thing you could spend your money on,” he said, per The Motley Fool.

Discretionary expenses like travel take away from money you could be investing and, according to his Ramsey Solutions site, travelers tend to be carefree with their spending while on vacation, wasting an inordinate amount of money on silly purchases while away.

Take Our Poll: What Kind of Money Advice Would You Most Trust From a Celebrity Expert Such as Warren Buffett, Mark Cuban or Suze Orman?

However, many modern pundits suggest that spending money on experiences makes people happier than buying possessions or assets. With that in mind, even a “saving and investment first” expert like Ramsey has some tips on saving money on travel. Here are five things to keep in mind if you want to save money while you’re on holiday, per Ramsey’s site.

1. Stop Eating Out for Every Meal and Cut Out Expensive Snacks

As the restaurant industry may never return to its pre-pandemic state, eating out continues to be pricey. Going to restaurants is a major attraction for travelers and often the main attraction in world-famous foodie cities. While cooking on vacation runs antithetical to holiday fun, eating one meal per day where you are staying will help fight inflation’s significant impact on restaurants, from upscale eateries to less expensive truck stops or food chains.

Full meals are expensive, but at least they are usually planned and budgeted. Buying spur-of-the-moment snacks at amusement parks, sporting/entertainment events and popular tourist sites is done out of convenience and priced to trap vacationers looking to spend money. Skipping treats will save you plenty. Remember, every dollar you don’t spend at a restaurant or on a costly treat is a dollar you can spend elsewhere on your travels — or on saving for your next adventure.

2. Skip Flying to Drivable Destinations

The urge to fly away on vacation makes sense. You will maximize your time away by getting to your retreat quicker, and the mere fact that you’re flying makes the vacation rarer and more adventurous. However, don’t let your mind trick you into booking an airline ticket for a destination you can easily drive to.

According to Ramsey Solutions, “Filling up your gas tank a few times is cheaper than buying a lot of plane tickets. Then you’ll have more cash for the actual trip. Besides, some of the best bonding happens when you spend a few hours together on the road.”

3. Think Twice About Buying Pointless Souvenirs

It goes without saying that buying souvenirs is part and parcel of a fun holiday experience. However, traditional clothing that will never get worn, cheaply-made trinkets that will get thrown out upon arriving home, bulky items that are a pain to carry — these are things you should think twice about buying.

Leaving spare space in your suitcase for something usable and personal is a great idea, while spending for the sake of spending on vacation is a costly mistake. You should never deny what will make you happy, but you’ll return to a picture taken while away more frequently than an impulse buy cluttering up your house or apartment.

4. Don’t Stay Too Long or Do Too Much

Dragging out a vacation can eventually grate on your nerves and paying between $150 and $300 a night for too many days makes it hard to enjoy your time traveling. Citing psychologist Daniel Kahneman’s behavioral science work, Business Insider’s Chris Weller suggested that spending more on a longer vacation is probably not worth the expense. “You most likely aren’t ‘changing the story’ enough to create new memories about the experience,” he wrote. “Instead, it all eventually blends into one amorphous memory.”

Likewise, do you want your lasting memory of a trip away to be that of running yourself ragged just to prove you have been somewhere or done something? “I know the urge to see and do as much as possible is strong, especially when vacation days are limited, but it’s hard to enjoy each activity if you’re constantly in a rush,” said Marek Bron, a travel blogger at Indie Traveller. Bron suggests cutting your itinerary by a third. That way you give yourself more time to relax while traveling, decompress when you return and save money throughout.

5. Budget for Your Vacation and Check for Discounted Attractions

When traveling, it’s easy to fall into a vacation mindset and simply shell out for any expense without giving it a second thought.

Ramsey Solutions suggested that budgeting for your vacation, deciding when to travel, picking a destination and determining the cost of your trip before you leave will keep your spending in check — and will prevent clouding of your judgment when away. If your vacation involves paid events or local attractions, you should be scouting out ways to experience them by using discounts or coupons (or finding deals through visitor or tourist centers).

Keeping a bunch of travel tips in mind seems counterproductive to shifting into vacation mode, but enjoying your time away should be exciting and relaxing, not financially stressful.

More From GOBankingRates

- I'm a Real Estate Agent: Buy Real Estate in These 10 Cities To Be Rich in 10 Years

- See GOBankingRates' Top 100 Most Influential Money Experts and Get Advice

- 3 Things You Must Do When Your Savings Reach $50,000

- What's the Best Small Business in Your State? Vote For Your Favorite

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Tips for Saving Money on Travel

2023-06-19T17:28:44Z dg43tfdfdgfd